In an era where financial literacy and empowerment are increasingly emphasized, the demand for reliable and accessible wealth management and investment resources has never been higher. A well-designed and informative website can serve as a valuable tool for individuals seeking to navigate the complexities of financial planning, investment management, and wealth accumulation. Whether you’re a financial advisor, investment firm, or wealth management company, creating the best wealth management or investment website requires careful planning, strategic design, and a commitment to delivering value to your audience. In this article, we’ll explore the essential elements and strategies for building a standout wealth management or investment website that educates, engages, and empowers visitors on their journey towards financial success.

1. Define Your Audience and Objectives:

Before diving into website development, it’s crucial to define your target audience and overarching objectives. Consider the specific demographic you aim to serve—whether it’s high-net-worth individuals, retirees, young professionals, or small business owners—and tailor your website content and features to meet their unique needs and preferences. Clarify your primary objectives, whether it’s to attract new clients, provide educational resources, or showcase your firm’s expertise and offerings.

2. Establish Credibility and Trust:

Building trust is paramount in the realm of wealth management and investment services. Your website should convey professionalism, credibility, and transparency to instill confidence in visitors. Incorporate elements such as client testimonials, industry certifications, awards, and affiliations prominently on your website to showcase your track record and expertise. Additionally, provide transparent information about your firm’s investment philosophy, approach, team members, and regulatory compliance to reassure visitors of your commitment to ethical and responsible practices.

3. Craft Compelling Content and Resources:

Content is king when it comes to engaging and educating visitors on financial matters. Develop a robust content strategy that offers valuable resources, insights, and educational materials to address common financial concerns and objectives. Create blog posts, articles, guides, and whitepapers on topics such as retirement planning, investment strategies, tax optimization, family office, estate planning, and market trends. Ensure that your content is informative, actionable, and easy to understand, catering to individuals at various levels of financial literacy and expertise.

4. Integrate Advanced Planning Tools and Calculators:

Empower visitors to take control of their financial future by incorporating advanced planning tools and calculators on your website. Offer interactive tools for retirement planning, investment risk assessment, college savings planning, mortgage affordability, and tax estimation to help users make informed decisions and visualize their financial goals. Consider partnering with reputable financial software providers or developing custom tools tailored to your firm’s expertise and client needs.

5. Provide Personalized Services and Solutions:

Tailor your website experience to cater to the individual needs and preferences of your target audience. Offer personalized services such as portfolio analysis, financial planning consultations, and investment recommendations based on each client’s goals, risk tolerance, and time horizon. Implement client portals or dashboards that provide real-time access to account information, performance reports, and transaction history, fostering transparency and communication between clients and advisors.

6. Optimize for User Experience and Accessibility:

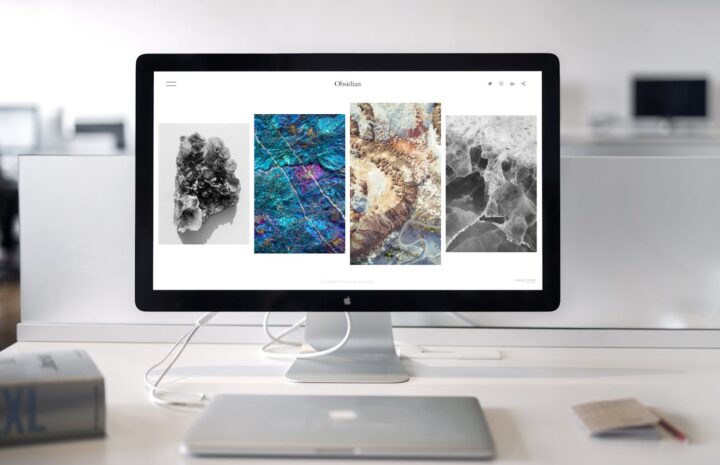

A seamless user experience is essential for retaining visitors and encouraging engagement on your website. Ensure that your website is intuitive, easy to navigate, and optimized for both desktop and mobile devices. Use clear navigation menus, logical page layouts, and prominent calls-to-action to guide visitors towards their desired information and actions. Pay attention to accessibility considerations, such as contrast, font size, and keyboard navigation, to accommodate users with disabilities and enhance inclusivity.

7. Implement Robust Security Measures:

Security is paramount when dealing with sensitive financial information and transactions. Invest in robust cybersecurity measures to protect your website and clients’ data from potential threats and breaches. Utilize SSL encryption, firewalls, malware detection, and regular security audits to safeguard against unauthorized access and data breaches. Communicate your commitment to data security and privacy through transparent privacy policies and compliance with industry regulations such as GDPR and CCPA.

8. Integrate Social Proof and Testimonials:

Leverage social proof and testimonials to reinforce trust and credibility on your website. Showcase positive client experiences, success stories, and testimonials prominently to demonstrate the value and impact of your services. Incorporate client reviews, ratings, and endorsements from reputable sources such as Google My Business, Yelp, and industry associations to validate your firm’s reputation and expertise.

9. Offer Seamless Integration with Other Financial Tools and Platforms:

Facilitate seamless integration with other financial tools and platforms to enhance the functionality and utility of your website. Integrate with popular financial management software, investment platforms, and customer relationship management (CRM) systems to streamline processes, automate tasks, and provide a cohesive user experience. Enable features such as account aggregation, data synchronization, and single sign-on to enhance convenience and efficiency for both clients and advisors.

9. Promote Continuous Learning and Engagement:

Foster a culture of continuous learning and engagement by providing ongoing educational opportunities and interactive experiences on your website. Offer webinars, workshops, seminars, and events on relevant financial topics to educate and empower visitors. Encourage participation in discussions, polls, surveys, and quizzes to foster engagement and gather valuable insights into clients’ needs and preferences. Leverage email newsletters, social media channels, and online communities to stay connected with clients and prospects and nurture relationships over time.

By incorporating these essential elements and strategies into your wealth management or investment website, you can create a compelling online presence that attracts, engages, and retains clients while positioning your firm as a trusted partner in their financial journey. And as you focus on building your digital presence, don’t forget to explore valuable wealth management solutions offered by companies like Certuity, providing comprehensive financial planning and investment management services to help individuals and families achieve their long-term financial goals with confidence.